Some Known Details About Eb5 Investment Immigration

Some Known Details About Eb5 Investment Immigration

Blog Article

Eb5 Investment Immigration - Truths

Table of ContentsSome Known Details About Eb5 Investment Immigration Our Eb5 Investment Immigration StatementsGetting My Eb5 Investment Immigration To WorkEverything about Eb5 Investment ImmigrationWhat Does Eb5 Investment Immigration Do?

While we strive to supply precise and current content, it ought to not be considered legal recommendations. Immigration legislations and guidelines are subject to change, and private scenarios can differ commonly. For individualized advice and lawful guidance regarding your specific immigration circumstance, we strongly advise speaking with a qualified migration attorney who can offer you with tailored help and make sure conformity with current regulations and guidelines.

Citizenship, through financial investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Backwoods) and $1,050,000 elsewhere (non-TEA zones). Congress has authorized these quantities for the next 5 years beginning March 15, 2022.

To receive the EB-5 Visa, Financiers must create 10 permanent U.S. tasks within 2 years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement guarantees that financial investments contribute directly to the united state job market. This applies whether the jobs are produced straight by the business or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

Eb5 Investment Immigration Can Be Fun For Anyone

These work are figured out through designs that utilize inputs such as growth costs (e.g., construction and devices expenditures) or annual profits produced by continuous procedures. In contrast, under the standalone, or straight, EB-5 Program, only straight, permanent W-2 employee settings within the business business may be counted. A crucial danger of counting solely on direct employees is that team decreases due to market conditions could lead to inadequate permanent positions, potentially leading to USCIS rejection of the investor's request if the work development requirement is not satisfied.

The financial model then forecasts the variety of straight jobs the brand-new service is likely to produce based on its awaited profits. Indirect work calculated via financial versions refers to employment generated in markets that provide the goods or services to the service straight associated with the job. These work are created as a result of the raised demand for products, products, or services that support the business's procedures.

Some Known Details About Eb5 Investment Immigration

An employment-based 5th choice classification (EB-5) financial investment visa go to these guys supplies an approach of coming to be a permanent united state resident for foreign nationals hoping to invest resources in the United States. In order to request this copyright, an international financier must invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Location") and develop or protect at the very least 10 full-time work for United States employees (leaving out the investor and their immediate household).

This measure has actually been a remarkable success. Today, 95% of all EB-5 capital is raised and spent by Regional Centers. Given that the 2008 financial crisis, access to funding has actually been restricted and municipal budget plans remain to face considerable shortfalls. In several areas, EB-5 financial investments have actually loaded the financing gap, offering a brand-new, important source of capital for regional economic growth tasks that renew neighborhoods, produce and support jobs, infrastructure, and solutions.

The Greatest Guide To Eb5 Investment Immigration

workers. Additionally, the Congressional Budget Plan Workplace (CBO) scored the program as revenue neutral, with administrative costs spent for by applicant charges. EB5 Investment Immigration. Greater than 25 nations, consisting of Australia and the UK, use comparable programs to bring in foreign financial investments. The American program is much more rigid than lots of others, calling for substantial danger for capitalists in terms of both their monetary investment and immigration standing.

Households and individuals that seek to transfer to the USA on an irreversible basis can look for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Migration Services (U.S.C.I.S.) established out different requirements to get permanent residency via the EB-5 visa program. The requirements can be summed up as: The financier should fulfill capital financial investment amount demands; it is normally needed to make either a $800,000 or $1,050,000 capital investment quantity into a UNITED STATE

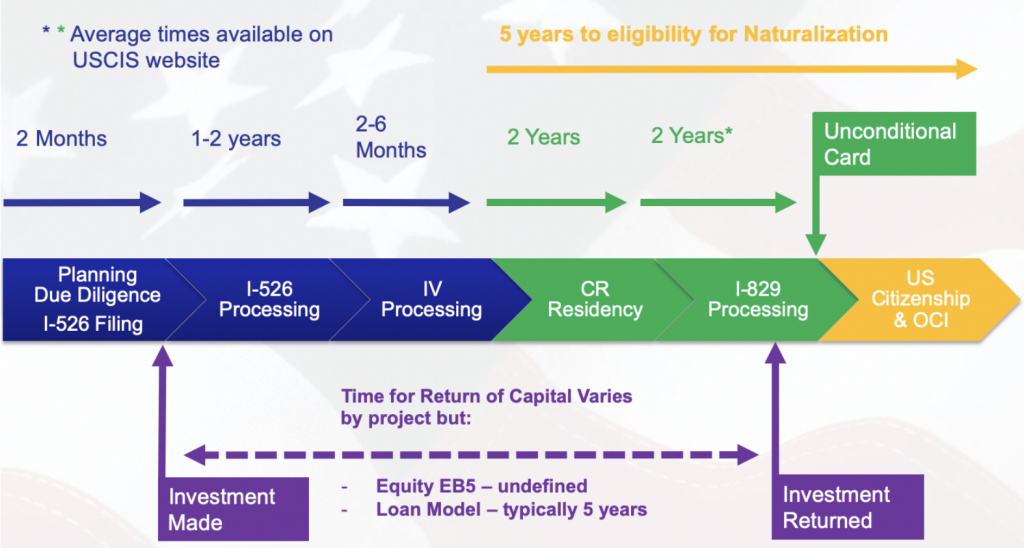

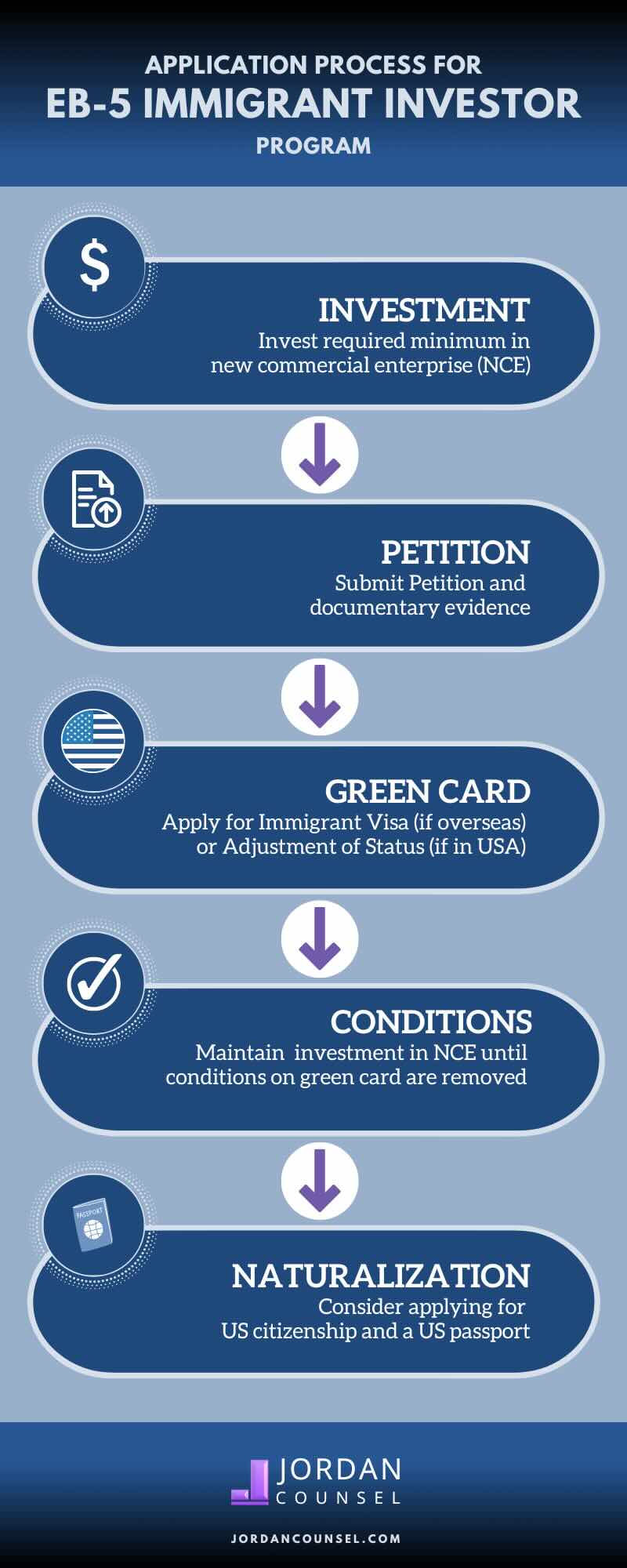

Speak with a Boston immigration attorney regarding your demands. Here are the basic actions to obtaining an EB-5 capitalist permit: The initial step is to discover a certifying financial investment possibility. This can be a new business enterprise, a regional center task, or an existing business that will be increased or restructured.

Once the chance has been determined, the financier must make the investment and submit an I-526 request to the united state Citizenship and Migration Provider (USCIS). This petition needs to consist of proof of the investment, such as bank declarations, acquisition Look At This contracts, and organization strategies. The USCIS will evaluate the I-526 petition and either approve it or request additional proof.

The 7-Minute Rule for Eb5 Investment Immigration

The investor should request conditional residency by sending an I-485 request. This petition has to be submitted within 6 months of the I-526 approval and should include proof that the investment was made and that it has actually created at least 10 permanent tasks for U.S. workers. The USCIS will assess the I-485 request and either accept it or request additional proof.

Report this page